Tesla Inc., the renowned electric vehicle manufacturer led by Elon Musk, has captured the world’s attention with its innovative products and ambitious vision for the future of transportation. As Tesla continues to disrupt the automotive industry, investors are closely monitoring the company’s stock performance and prospects. In this comprehensive stock analysis, we will delve into Tesla’s financial performance, growth potential, key drivers, and potential risks to provide a holistic view for investors and enthusiasts alike.

Contents

Tesla’s Financial Performance

Revenue and Sales Growth

Tesla’s revenue growth has been impressive over the years, driven by increasing demand for its electric vehicles and energy products. The company’s sales have soared due to the popularity of models like the Model S, Model 3, Model X, and Model Y.

Profitability and Margins

While Tesla’s revenue growth has been robust, its profitability has been a subject of scrutiny. The company has experienced fluctuations in its margins, influenced by factors such as production challenges, supply chain issues, and research and development expenses.

Cash Flow and Liquidity

Maintaining a healthy cash flow is crucial for sustaining growth and funding future projects. Tesla’s ability to generate positive cash flow and manage its liquidity will significantly impact its long-term prospects.

Factors Driving Tesla’s Success

Technological Innovation

Tesla’s success can be attributed to its relentless focus on technological innovation. The company has set industry standards with its cutting-edge electric vehicle technology, advanced battery systems, and autonomous driving capabilities.

Brand Loyalty and Market Presence

Tesla has cultivated a passionate and dedicated customer base, fostering strong brand loyalty. Its global presence and expanding network of Supercharger stations have given it a competitive edge in the electric vehicle market.

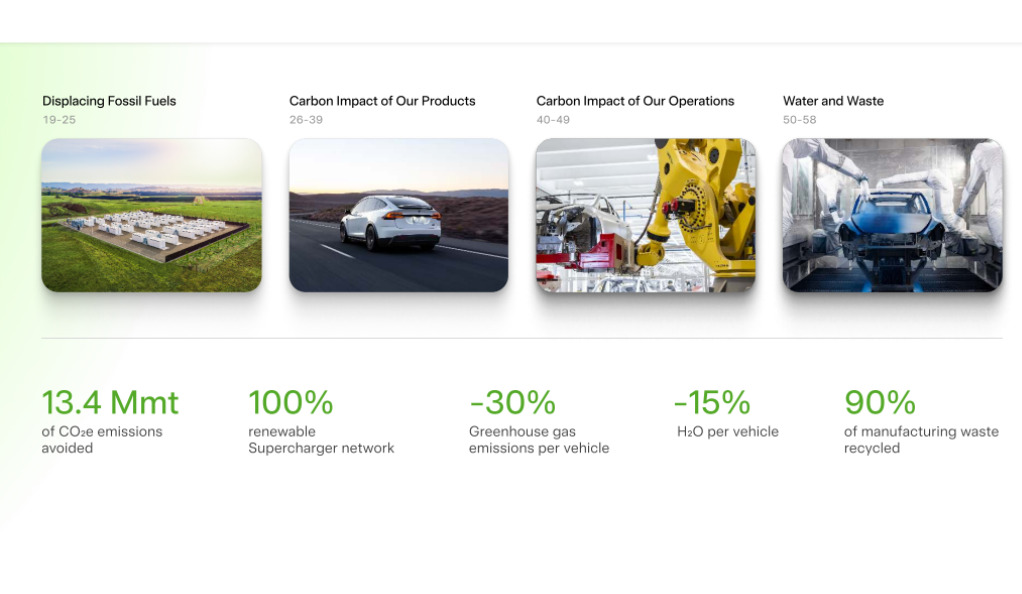

Environmental and Sustainability Initiatives

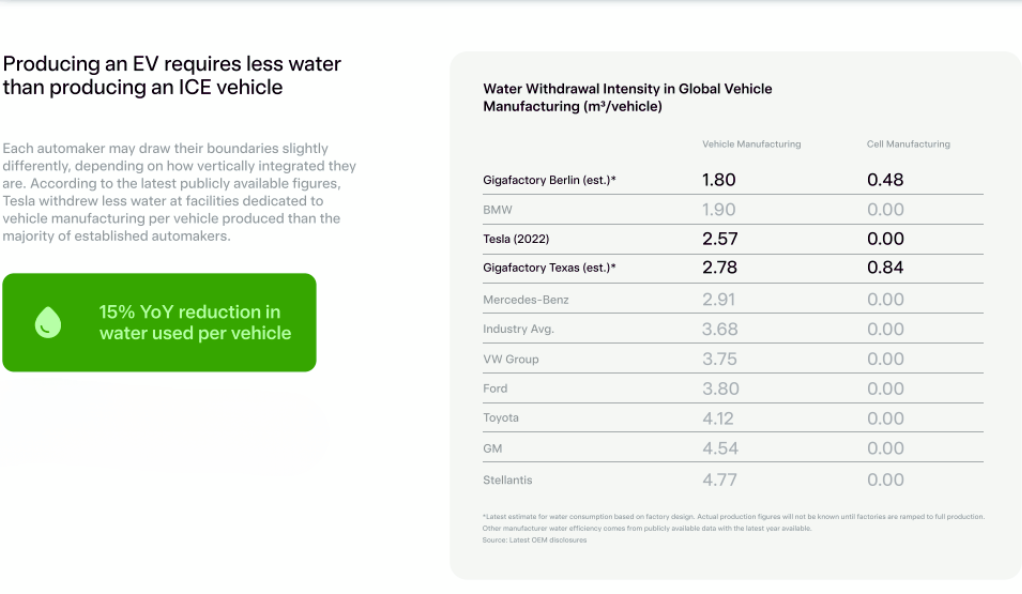

With an increasing emphasis on sustainability, Tesla’s commitment to reducing carbon emissions and promoting renewable energy aligns with the growing demand for environmentally responsible products.

Challenges and Risks

Competition in the EV Market

As the electric vehicle market continues to grow, Tesla faces stiff competition from both established automakers and emerging startups. Maintaining a competitive advantage will be critical for its long-term success.

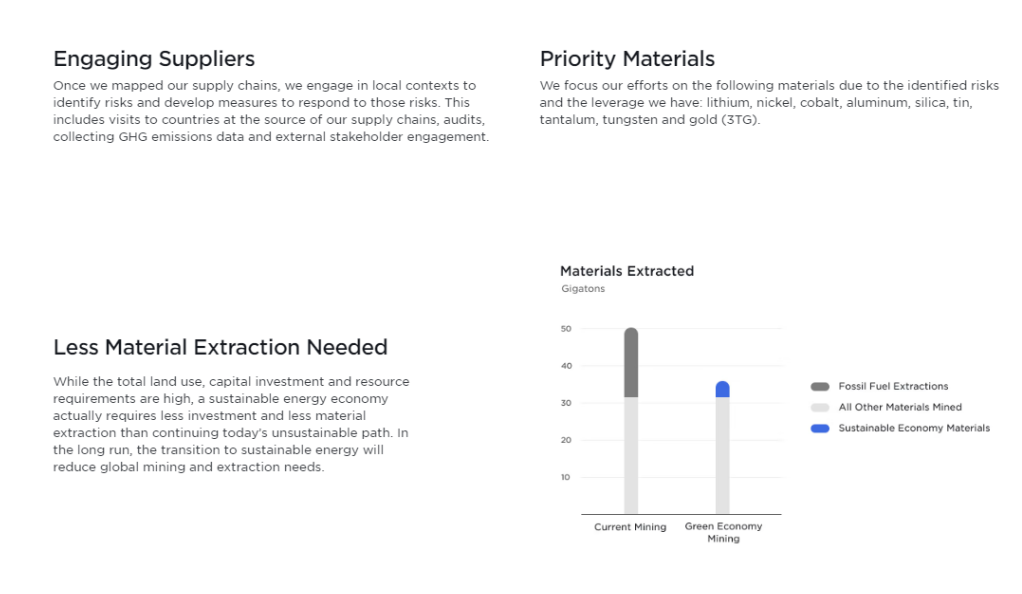

Supply Chain Vulnerabilities

Tesla’s complex supply chain is susceptible to disruptions, affecting production and delivery timelines. Addressing supply chain vulnerabilities will be crucial for meeting demand and satisfying customers.

Regulatory and Policy Changes

Government regulations and policy changes related to electric vehicles and renewable energy could impact Tesla’s operations and profitability.

Tesla’s Growth Prospects

- International Expansion: Tesla’s expansion into international markets presents significant growth opportunities. As it establishes a presence in countries worldwide, the company can tap into new customer bases and diversify revenue streams.

- Energy Business Growth: Beyond electric vehicles, Tesla’s energy business, including solar energy products and energy storage solutions, offers a promising avenue for growth.

- Autonomous Driving: Tesla’s advancements in autonomous driving technology have the potential to revolutionize transportation and unlock new revenue streams.

Conclusion

In conclusion, Tesla’s stock analysis reveals a company that has captivated the world with its innovative approach to electric vehicles and renewable energy. While facing challenges and risks, Tesla’s potential for growth and positive impact on the environment positions it as an attractive investment opportunity for those aligned with its vision for the future.

FAQs

Tesla’s profitability has been volatile, with periods of profitability interspersed with losses due to various factors impacting its margins.

Tesla’s focus on technological innovation, commitment to sustainability, and brand loyalty sets it apart from traditional automakers.

International expansion offers Tesla access to new markets and diversification, presenting significant growth opportunities.

Tesla investors should be mindful of competition in the EV market, supply chain vulnerabilities, and regulatory changes.

Tesla contributes to sustainability through its electric vehicles and energy products, which aim to reduce carbon emissions and promote renewable energy.

At DailyTrendingStocks, we are dedicated to providing impartial and dependable information on topics such as cryptocurrency, finance, trading, and stocks. It's important to note that we do not have the capacity to provide financial advice, and we strongly encourage users to engage in their own thorough research.

Read More