Introduction

In the world of finance and investing, numerous strategies are employed to build wealth and achieve financial goals. One such approach that has garnered immense popularity and success over the years is value investing. Value investing is a strategy that involves buying undervalued assets with the expectation that their true value will be recognized in the future. It is a time-tested and proven approach embraced by some of the most successful investors, including Warren Buffett and Benjamin Graham. In this article, we will delve into the principles of value investing, discuss how to identify undervalued assets, explore the benefits and risks associated with this strategy, and provide valuable insights to help you build a successful value investing portfolio.

Contents

- 1 Introduction

- 2 What is Value Investing?

- 3 The Principles of Value Investing

- 4 How to Identify Undervalued Assets

- 5 The Benefits of Value Investing

- 6 The Risks of Value Investing

- 7 Successful Value Investing Strategies

- 8 Key Metrics for Value Investors

- 9 Famous Value Investors and Their Success Stories

- 10 Long-Term vs. Short-Term Value Investing

- 11 Value Investing in Different Market Conditions

- 12 Value Investing vs. Growth Investing

- 13 Building a Value Investing Portfolio

- 14 Diversification and Risk Management in Value Investing

- 15 Conclusion

- 16 FAQs

What is Value Investing?

At its core, value investing is about identifying and investing in assets that are trading below their intrinsic value. The underlying premise is that the market may occasionally misprice assets due to short-term fluctuations, investor sentiment, or other factors. Value investors take advantage of these discrepancies and invest in assets that they believe are undervalued. They then patiently wait for the market to recognize the true value of these assets, leading to price appreciation over time.

The Principles of Value Investing

Value investing is not just about buying cheap assets; it is a disciplined approach guided by several key principles:

Patience and Long-Term Vision

Value investors are patient and have a long-term investment horizon. They understand that recognizing the true value of an asset may take time, and they are willing to hold onto their investments for years or even decades. This patient outlook is essential because the market can be unpredictable in the short term, and prices may not always reflect the underlying value of an asset. By maintaining a long-term perspective, value investors give their investments ample time to grow and realize their full potential.

Margin of Safety

A crucial concept in value investing is the idea of a margin of safety. Investors aim to purchase assets at a price significantly below their intrinsic value. By doing so, they create a buffer against potential losses, reducing the impact if the market does not recognize the asset’s true value as quickly as anticipated. The margin of safety provides a level of protection and allows investors to weather market fluctuations with confidence. It ensures that even if the investment does not immediately perform as expected, there is still room for the asset’s value to be recognized over time.

How to Identify Undervalued Assets

Identifying undervalued assets requires thorough research and analysis. Here are some essential methods used by value investors:

- Fundamental Analysis

Value investors conduct extensive fundamental analysis of companies or assets. This analysis involves scrutinizing financial statements, cash flow, balance sheets, and overall business prospects. The goal is to gain insights into the company’s intrinsic value and growth potential. By understanding the fundamental health of the company, investors can make informed decisions about whether the asset is undervalued and likely to grow in the future.

- Price-to-Earnings Ratio (P/E Ratio)

The P/E ratio is a fundamental valuation metric used by value investors. It compares a company’s stock price to its earnings per share (EPS). A low P/E ratio relative to industry peers may indicate an undervalued stock. A low P/E ratio suggests that the market is not giving the company enough credit for its earnings potential, which could present an opportunity for value investors to acquire the stock at a bargain price.

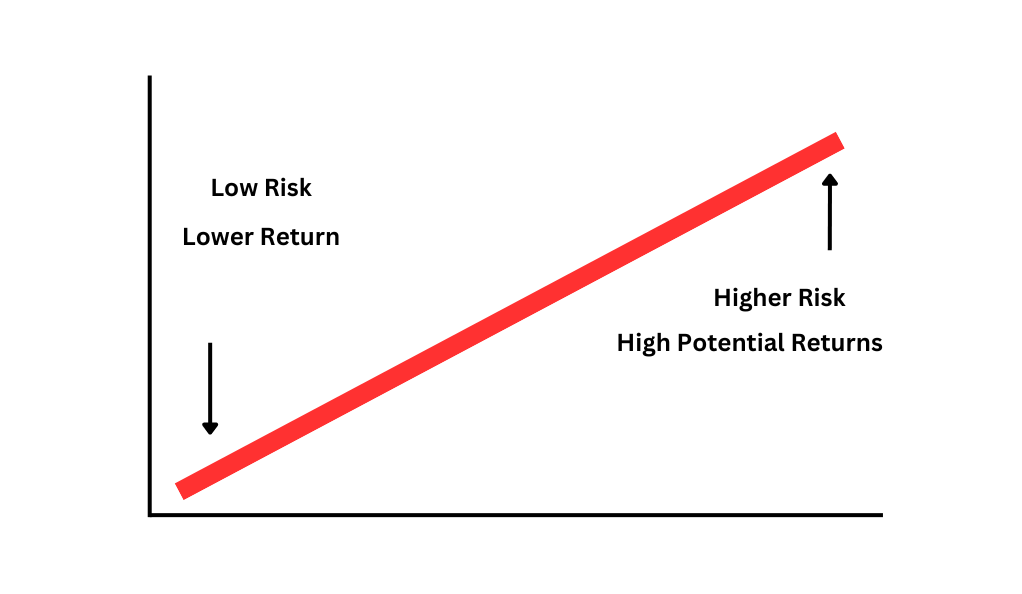

The Benefits of Value Investing

Value investing offers several advantages to investors who adopt this strategy:

- Lower Downside Risk

By buying undervalued assets with a margin of safety, value investors reduce the potential downside risk of their investments. Even if the market experiences temporary declines, the discounted purchase price provides some protection. This risk reduction is crucial for investors seeking to preserve capital while still participating in the growth potential of the asset. Lower downside risk also translates to greater peace of mind, allowing investors to stay committed to their long-term investment plan without being overly swayed by short-term market fluctuations. - Potential for High Returns

When the market recognizes the true value of an asset, there is significant potential for high returns. As undervalued assets appreciate, investors can benefit from substantial capital gains. Value investors often enjoy the satisfaction of seeing their investments grow and outperform the overall market. This potential for high returns is a primary motivation for many value investors, as it presents an opportunity to build wealth and achieve financial goals.

The Risks of Value Investing

While value investing can be rewarding, it is essential to be aware of the potential risks:

Value Traps

Not all undervalued assets will increase in value as anticipated. Some assets may be “value traps,” where the underlying business fails to perform well, leading to further declines in value. Value investors must exercise caution and conduct thorough research to avoid falling into value traps. This risk underscores the importance of conducting proper due diligence before investing in any asset.

Waiting for Recognition

Value investing requires patience, and it may take time for the market to recognize the true value of an asset. During this period, the investment may not perform as expected. This waiting period can test the patience of investors, especially during periods of market volatility or when other investment strategies appear to be yielding more immediate results. However, value investors understand that true value is not always immediately apparent, and they remain committed to their long-term vision.

Successful Value Investing Strategies

Value investors employ various strategies to identify promising opportunities:

Contrarian Investing

Value investors often take a contrarian approach, investing in assets that are currently unpopular or out of favor. Contrarian thinking allows them to find assets with strong fundamentals but temporarily depressed prices. By going against the crowd, value investors can uncover hidden gems that others may overlook due to short-term market sentiment.

Dividend Investing

Dividend-paying stocks are favoured by value investors. These stocks provide a consistent income stream through dividends, offering a source of cash flow while waiting for the asset’s value to appreciate. Dividend investing aligns with the long-term orientation of value investing, as investors can reinvest the dividends to compound their returns over time.

Key Metrics for Value Investors

Value investors rely on specific metrics to assess the attractiveness of an investment:

Return on Equity (ROE)

ROE measures a company’s profitability relative to shareholders’ equity. A high ROE may indicate an undervalued stock. Value investors look for companies with strong ROEs, as it suggests that the company is efficiently using its equity to generate profits for shareholders.

Debt-to-Equity Ratio

A low debt-to-equity ratio is preferred by value investors. It indicates that a company is not heavily reliant on borrowed capital, reducing financial risk. Companies with low debt-to-equity ratios are more likely to weather economic downturns and are generally considered more stable investments.

Famous Value Investors and Their Success Stories

Several renowned investors have achieved remarkable success through value investing:

Warren Buffett

Warren Buffett is perhaps the most famous value investor of all time. He follows the principles of his mentor, Benjamin Graham, seeking undervalued companies with strong long-term prospects. Buffett’s disciplined approach and patient outlook have made him one of the wealthiest individuals globally. His success story serves as an inspiration for aspiring value investors and reinforces the timeless principles of value investing.

Long-Term vs. Short-Term Value Investing

Value investing can be practiced with different time horizons:

Long-Term Value Investing

Long-term value investing involves holding undervalued assets for an extended period, typically many years. This approach aligns with the principle of patience and allows investors to capture the asset’s full potential. Long-term value investors focus on the intrinsic value of assets and are less concerned with short-term price fluctuations.

Short-Term Value Investing

Short-term value investing, often referred to as swing trading, involves capitalizing on short-term price fluctuations in undervalued assets. Investors may take advantage of temporary market inefficiencies to buy and sell quickly. While short-term value investing can yield rapid gains, it requires a more active approach and may not align with the patient nature of traditional value investing.

Value Investing in Different Market Conditions

The performance of value investing can vary based on prevailing market conditions:

Bull Markets

In bull markets, where the overall market is rising, value investors may find it challenging to identify undervalued assets as most stocks experience price appreciation. However, there are still opportunities in certain sectors or industries that may be overlooked. Value investors must be diligent in their research and select assets with strong fundamentals that can outperform the broader market.

Bear Markets

In bear markets, where the market experiences a sustained decline, value investors often find more opportunities. Market pessimism may lead to undervalued assets, and value investors can capitalize on potential bargains. During bear markets, value investors can acquire assets at discounted prices, positioning themselves for significant gains when the market eventually rebounds.

Value Investing vs. Growth Investing

Both value investing and growth investing are popular investment strategies, each with its distinct focus:

Value Investing

Value investing concentrates on buying undervalued assets and generating returns through price appreciation. Investors seek companies with solid fundamentals but perceived by the market as undervalued. Value investors often look for assets that are trading below their intrinsic value and have the potential for long-term growth.

Growth Investing

Growth investing, on the other hand, centers on companies that are expected to experience substantial revenue and earnings growth. These companies may not always be undervalued but are valued for their potential for rapid expansion. Growth investors focus on companies with high growth prospects and are often willing to pay a premium for these opportunities.

Building a Value Investing Portfolio

Constructing a successful value investing portfolio requires careful planning:

Diversification

Value investors diversify their portfolios across various industries and asset classes to spread risk. Diversification helps reduce the impact of any single investment’s poor performance on the overall portfolio. By holding a diverse range of assets, value investors can mitigate risk and enhance the potential for overall portfolio returns.

Value Stocks vs. Value Funds

Investors can choose to invest directly in individual value stocks or opt for value-focused mutual funds or exchange-traded funds (ETFs). Value funds provide a diversified approach to value investing and may suit investors seeking professional management. On the other hand, investing in individual value stocks allows investors to exercise more control over their portfolio and to select specific companies they believe are undervalued.

Diversification and Risk Management in Value Investing

Value investors actively manage risk through several strategies:

Managing Risk

Value investors thoroughly assess the risks associated with their investments. They carefully analyze potential pitfalls and drawbacks before making investment decisions. By understanding the risks, value investors can make informed choices and implement risk management strategies to protect their capital.

Balancing a Portfolio

Balancing a portfolio with a mix of value and growth investments can help achieve a healthy risk-reward balance. This combination allows investors to benefit from both value opportunities and potential growth prospects. By diversifying their holdings, value investors can capture returns from different investment styles and market conditions.

Conclusion

Value investing is a time-honored and effective strategy for building long-term wealth. By focusing on undervalued assets and exercising patience, investors can potentially achieve significant returns. However, value investing requires discipline, thorough research, and a long-term perspective. It may not be suitable for everyone, and individual investors should consider their risk tolerance and financial goals before adopting this approach. Ultimately, value investing remains a valuable tool for those seeking to create wealth and secure their financial future.

FAQs

Yes, value investing can be a viable strategy for beginners. However, beginners should take the time to learn and understand the fundamental analysis involved in value investing. They should also be prepared for the long-term commitment required for successful value investing.

Value investing typically requires a long-term investment horizon, ranging from several years to decades. Short-term investors may not fully realize the potential benefits of this strategy, as it is focused on long-term growth and value recognition.

While value investing has historically outperformed the overall market in the long term, there are no guarantees in investing. Consistent success in value investing requires discipline, research, and a focus on long-term value rather than short-term fluctuations. Beating the market consistently is challenging, but value investing offers a disciplined approach that can lead to attractive returns over time.

Regular portfolio review is essential, but value investing often calls for a longer holding period. Investors should review their portfolios periodically to ensure the assets align with their investment objectives and to make any necessary adjustments. However, excessive trading or frequent changes to the portfolio may undermine the long-term focus of value investing.

Dividends play a crucial role in value investing as they provide a consistent income stream for investors. Dividend payments can contribute to overall portfolio returns, especially during periods of slow market growth. Additionally, reinvesting dividends can compound returns and enhance long-term performance.

At DailyTrendingStocks, we are dedicated to providing impartial and dependable information on topics such as cryptocurrency, finance, trading, and stocks. It's important to note that we do not have the capacity to provide financial advice, and we strongly encourage users to engage in their own thorough research.

Read More