Imagine you’re on a ship in the middle of the ocean. Sometimes the waters are calm, and other times, violent storms appear out of nowhere. This unpredictable nature of the sea is much like the financial markets. For investors, understanding these unpredictable waves and knowing how to navigate them is crucial. Let’s embark on this journey together.

Contents

Understanding Market Volatility

What is Market Volatility?

Market volatility is the unpredictable and rapid change in asset prices within a short period. It’s akin to the unpredictable waves in the ocean, sometimes calm and sometimes tumultuous. These fluctuations can be due to various reasons, and understanding them is the first step in navigating them.

Causes of Market Volatility

Market volatility is influenced by a myriad of factors. Economic data releases, such as employment numbers or interest rate changes, can sway markets. Geopolitical events, like elections or international conflicts, can also play a significant role. Additionally, unforeseen events like natural disasters can send shockwaves through the market. It’s a complex web of interconnected events that can lead to market ups and downs.

The Impact of Volatility on Investments

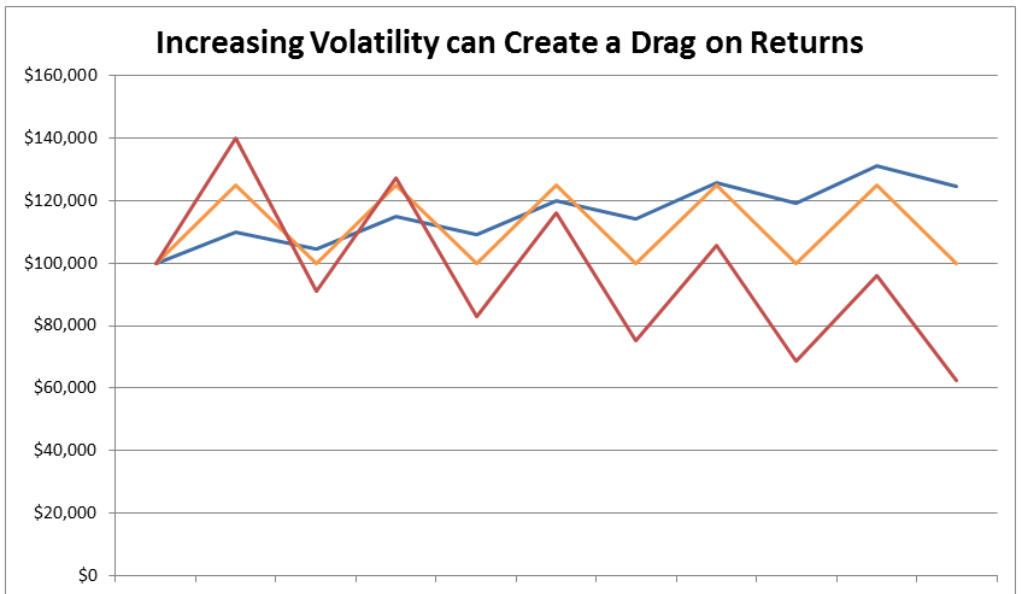

Short-term vs. Long-term Effects

In the short term, market volatility can be both a boon and a bane. While it can lead to significant gains, it can also result in substantial losses. However, if we zoom out and look at the long-term picture, markets tend to stabilize. It’s essential to remember that investing is more like a marathon than a 100-meter dash. Patience can often be an investor’s best ally.

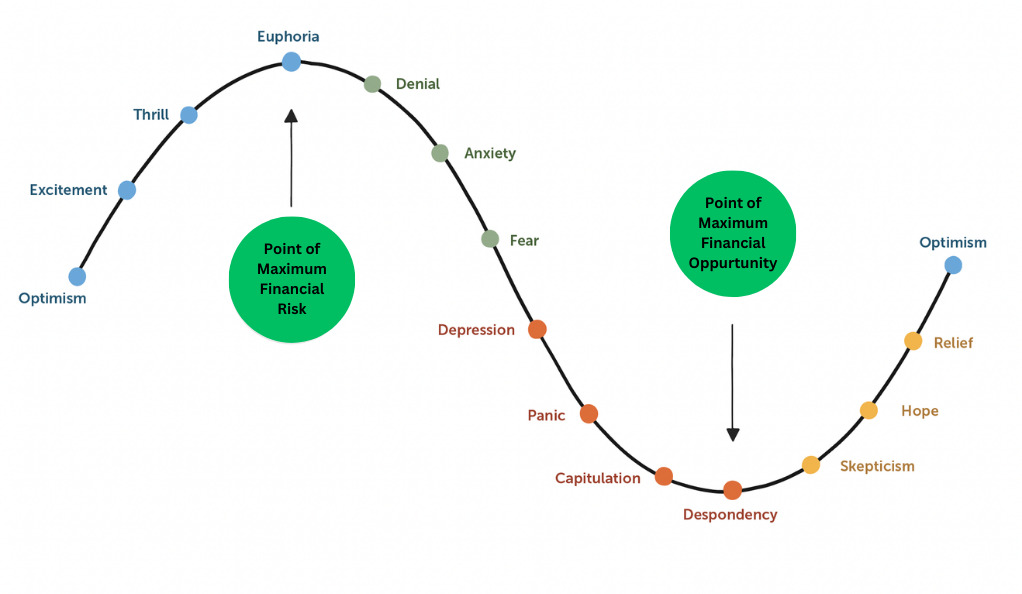

Emotional Impact on Investors

The financial implications of volatility are one thing, but the emotional toll it takes on investors is another ball game altogether. Watching your hard-earned money fluctuate can be nerve-wracking. It can lead to sleepless nights and hasty decisions. Recognizing this emotional roller coaster is the first step in managing it.

- Diversification

Think of diversification as a safety net. By spreading your investments across various assets, you reduce the risk of a significant loss in any one area. It’s the age-old wisdom of not putting all your eggs in one basket. Different assets react differently to market events, and having a mix can help balance things out.

- Dollar-Cost Averaging

Consistency is key with dollar-cost averaging. By investing a fixed amount regularly, regardless of market conditions, you can average out the cost of your investments. It’s like shopping throughout the year, sometimes during sales and sometimes not, but in the end, you get a decent average price.

- Keeping a Long-Term Perspective

The market’s daily ups and downs can be distracting, but it’s crucial to keep your eyes on the prize. Investments are typically not about making a quick buck but growing wealth over time. By maintaining a long-term perspective, you can ride out the storms of volatility.

- Avoiding Emotional Decisions

Emotions and investing are a dangerous mix. Making decisions based on fear or greed can often backfire. It’s essential to approach investing with a clear mind and a well-thought-out strategy, rather than getting swayed by the market’s mood.

Tools and Resources for Investors

- Financial Advisors

Navigating the choppy waters of the financial markets can be challenging. But you don’t have to do it alone. Financial advisors act as your guiding star, providing expert advice and helping you make informed decisions.

- Investment Research Platforms

Knowledge is power. Platforms like Bloomberg or Morningstar offer a wealth of information, from market news to in-depth analyses. These tools can arm you with the knowledge you need to navigate market volatility.

Preparing for Future Volatility

Building an Emergency Fund

An emergency fund is like a lifeboat on our ship. In times of financial distress, it ensures you don’t need to liquidate investments at a loss. It provides a cushion, allowing you to weather the storm without making hasty decisions.

Continuous Learning and Adaptation

Staying Updated with Market News

The financial world is ever-evolving. By staying updated with market news, you can anticipate and prepare for potential volatility. It’s like having a weather forecast for our ship, allowing us to prepare for storms in advance.

Engaging in Financial Workshops

Education is a lifelong journey. Financial workshops can offer deeper insights, new strategies, and a chance to learn from experts. They equip you with the tools you need to be a resilient and informed investor.

Conclusion

Navigating market volatility can be likened to a sailor confronting a tempest at sea. Instead of trying to avoid the storm, the sailor learns to harness the wind, adjust the sails, and navigate through the rough waters. Similarly, in the world of investing, it’s not about sidestepping the challenges that come with market fluctuations, but rather understanding and adapting to them.

Equipped with the right strategies, tools, and a resilient mindset, an investor can turn these challenges into opportunities. Just as a seasoned sailor emerges stronger and more skilled after navigating a storm, a savvy investor can not only weather the volatile phases of the market but also capitalize on them, ensuring growth and prosperity in their financial journey.

At DailyTrendingStocks, we are dedicated to providing impartial and dependable information on topics such as cryptocurrency, finance, trading, and stocks. It's important to note that we do not have the capacity to provide financial advice, and we strongly encourage users to engage in their own thorough research.

Read More