Microsoft, the software giant that has been dominating the tech industry for decades, has experienced impressive growth in recent years. In this article, we will analyze Microsoft’s stock performance and discuss the factors that have contributed to its success. We will also explore the risks and challenges the company faces and provide insights into potential investment strategies.

Contents

Company Overview

Microsoft Corporation is an American multinational technology company that specializes in software, hardware, and services. Founded in 1975 by Bill Gates and Paul Allen, Microsoft has grown to become one of the world’s largest and most valuable companies. Its flagship products include the Windows operating system, Office suite, Azure cloud platform, and Xbox gaming console.

Financial Performance

Revenue Growth

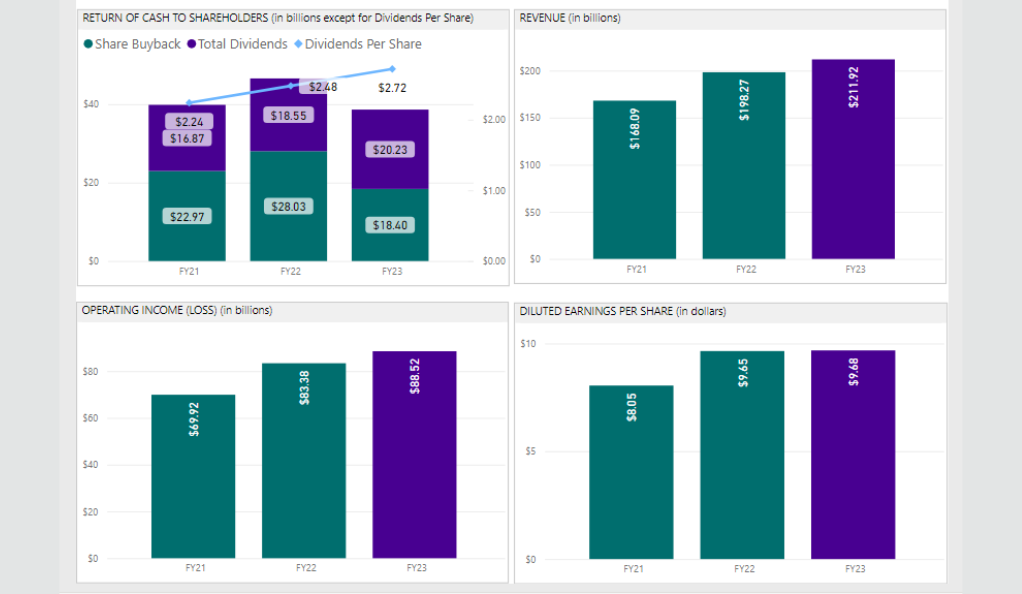

Microsoft has consistently delivered robust revenue growth over the years, driven by its diversified product portfolio and expanding market presence. In the past five years, the company’s annual revenue has grown at a compound annual growth rate (CAGR) of approximately 10%.

Profit Margins

Microsoft’s profit margins have also been impressive, with operating and net income margins consistently exceeding 30% and 20%, respectively. This can be attributed to the company’s focus on high-margin businesses, such as cloud computing and software-as-a-service (SaaS).

Earnings per share (EPS) is another key metric that has shown consistent growth for Microsoft. Over the past five years, the company’s EPS has grown at a CAGR of around 15%, reflecting strong profitability and effective capital allocation.

Microsoft faces intense competition in various segments, including cloud computing, productivity software, and gaming. Despite this, the company has maintained a strong market position in these areas, with a significant share of the global market.

Dividends and Stock Buybacks

Microsoft has a history of returning capital to shareholders through dividends and stock buybacks. The company has consistently increased its dividend payouts over the years and has repurchased billions of dollars’ worth of shares.

Innovations and Growth Drivers

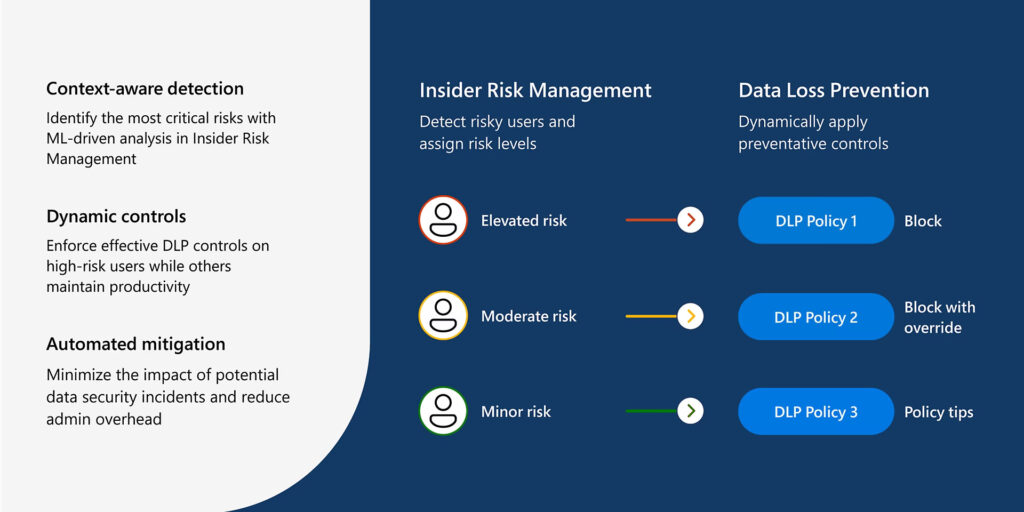

Microsoft’s continued success can be attributed to its ability to innovate and adapt to changing market conditions. Key growth drivers for the company include its Azure cloud platform, which has experienced rapid growth in recent years, and its focus on artificial intelligence and machine learning.

Risks and Challenges

Despite its strong performance, Microsoft faces several risks and challenges. These include increased competition from rivals like Amazon and Google, potential regulatory scrutiny, and the need to continually innovate to stay ahead of the curve.

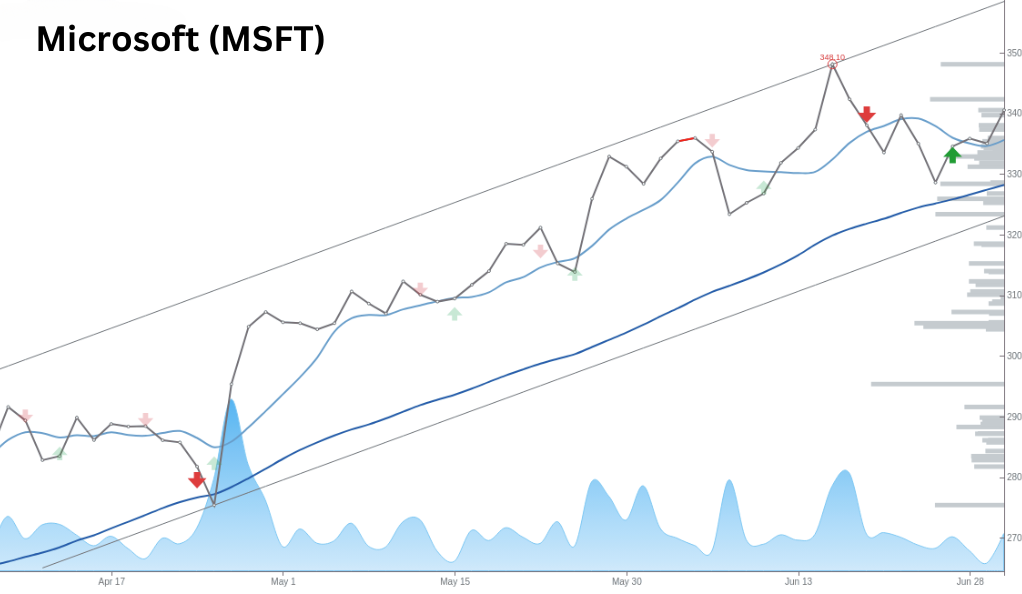

Technical Analysis

A technical analysis of Microsoft’s stock chart reveals a bullish trend, with the stock consistently trading above its moving averages. This suggests that investor sentiment remains positive, and the stock could continue to perform well in the near term.

Analyst Opinions and Price Targets

Many analysts have a favorable view of Microsoft’s stock, with the majority issuing “buy” or “strong buy” ratings. Price targets for the stock vary, but most analysts predict continued growth in the coming months.

Investment Strategies

Investors considering Microsoft as part of their portfolio should weigh the company’s strong financial performance, market leadership, and growth potential against the risks and challenges it faces. Long-term investors may benefit from the company’s consistent dividend payouts and stock buybacks, while short-term traders could capitalize on the stock’s bullish technical indicators.

Conclusion

Microsoft’s impressive financial performance, market leadership, and growth drivers make it an attractive investment option for many investors. However, it is essential to consider the risks and challenges the company faces before making any investment decisions.

FAQs

Microsoft generates revenue from various sources, including software, hardware, and services. Key products include the Windows operating system, Office suite, Azure cloud platform, and Xbox gaming console.

Microsoft holds a significant share of the global market in various segments, including cloud computing, productivity software, and gaming. However, it faces intense competition from rivals like Amazon and Google.

Some risks and challenges facing Microsoft include increased competition from rivals, potential regulatory scrutiny, and the need to continually innovate to stay ahead of the curve.

Microsoft’s strong financial performance can be attributed to its diversified product portfolio, expanding market presence, and focus on high-margin businesses like cloud computing and SaaS.

Long-term investors may benefit from Microsoft’s consistent dividend payouts and stock buybacks, while short-term traders could capitalize on the stock’s bullish technical indicators.

At DailyTrendingStocks, we are dedicated to providing impartial and dependable information on topics such as cryptocurrency, finance, trading, and stocks. It's important to note that we do not have the capacity to provide financial advice, and we strongly encourage users to engage in their own thorough research.

Read More