In this article, we will conduct a comprehensive analysis of Meta Platforms Inc. (Meta), formerly known as Facebook, focusing on its stock performance and overall financial health. We will explore the company’s business model, financials, SWOT analysis, and future outlook. Additionally, we’ll discuss regulatory challenges and privacy concerns that could impact the company’s growth. Let’s delve into the world of Meta and understand how it shapes the digital landscape.

Contents

What is Meta Platforms Inc. (Meta)?

Meta Platforms Inc. is a multinational technology company headquartered in California, USA. It is known for its prominent social media platforms, including Facebook, Instagram, WhatsApp, and Messenger. Recently, the company rebranded itself to Meta, signaling its intention to expand beyond social media into the metaverse – an interconnected virtual reality space.

Meta’s Stock Performance Overview

Historical Stock Performance

Meta’s journey in the stock market has been nothing short of remarkable. The company went public in 2012, and its initial public offering (IPO) was one of the most anticipated tech IPOs of the time. Over the years, Meta’s stock has experienced significant fluctuations, driven by market sentiment, product launches, and strategic announcements.

Recent Developments Affecting Stock

In recent times, Meta has made headlines with major announcements related to its metaverse ambitions, advancements in augmented reality, and plans for hardware products. Such developments have influenced the company’s stock price and generated both excitement and speculation among investors.

Meta’s Business Model

Products and Services

Meta’s primary revenue drivers are its social media platforms. Facebook remains its flagship product, generating substantial advertising revenue. Besides, Instagram, WhatsApp, and Messenger also contribute to the company’s overall revenue.

Revenue Streams

Meta’s revenue primarily comes from advertising. The company leverages its massive user base to offer targeted advertising solutions to businesses. Additionally, Meta explores other revenue streams, such as digital commerce, virtual reality products, and potential metaverse-related services.

Key Partnerships and Acquisitions

Over the years, Meta has strategically acquired companies to expand its offerings and enhance its technological capabilities. Key partnerships and acquisitions have helped Meta stay at the forefront of innovation and maintain its competitive edge.

Meta’s Financial Analysis

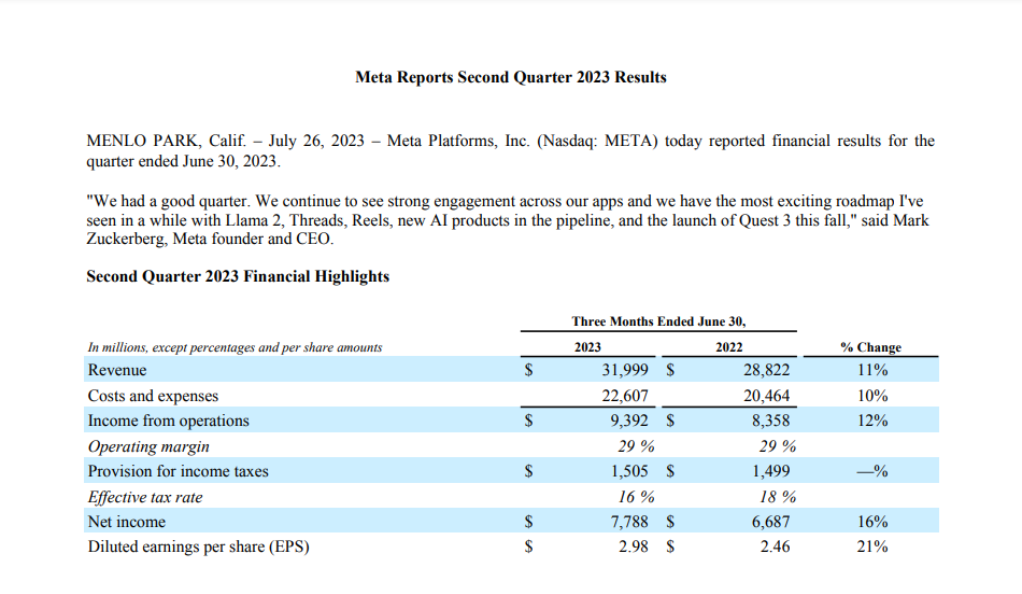

- Revenue and Earnings Trends: Meta’s financial performance has been impressive, with steady revenue growth over the years. The company’s ability to attract advertisers and engage users has translated into consistent earnings growth.

- Balance Sheet Analysis: A robust balance sheet has supported Meta’s expansion and acquisition strategies. The company’s financial position enables it to invest in research and development, driving technological advancements.

- Cash Flow Position: Meta has maintained a healthy cash flow position, ensuring it can fund ongoing operations and future initiatives without excessive reliance on debt.

SWOT Analysis of Meta

Strengths

Meta’s vast user base, strong brand recognition, and technological expertise form the backbone of its strengths. The company’s ability to innovate and pivot to emerging trends contributes to its resilience.

Weaknesses

Meta faces criticism and challenges related to privacy, content moderation, and user data protection. Addressing these concerns remains a crucial aspect of the company’s long-term sustainability.

Opportunities

The metaverse presents significant growth opportunities for Meta, allowing it to diversify beyond social media and explore new revenue streams.

Threats

Regulatory scrutiny, competition from other tech giants, and evolving consumer preferences pose potential threats to Meta’s market dominance.

Regulation and Privacy Concerns

Impact on Meta’s Business

Regulatory challenges have become a recurring issue for Meta. Privacy concerns, antitrust investigations, and content moderation debates have necessitated changes in the company’s policies and practices.

Company Responses and Initiatives

Meta has taken steps to address privacy concerns and enhance user data protection. The company has also engaged in dialogues with regulatory bodies to find common ground on contentious issues.

Meta’s Future Outlook

Expansion Plans

Meta is committed to shaping the future of the metaverse and investing in technologies that drive its vision. Expansion into virtual reality and augmented reality spaces remains a priority for the company.

Innovation and Technology Advancements

Meta continues to invest heavily in research and development to create innovative products and experiences. Advancements in artificial intelligence, virtual reality, and augmented reality are central to Meta’s growth strategy.

Investor Sentiment and Analyst Recommendations

Investor sentiment towards Meta remains optimistic, driven by its transformative vision and solid financial performance. Analyst recommendations vary, with many advocating a cautious approach due to regulatory uncertainties.

Conclusion

Meta Platforms Inc. (Meta) has come a long way from its humble beginnings as a social media platform. Today, the company is at the forefront of innovation, venturing into the metaverse and beyond. Its stock performance and financials indicate a company that has managed to navigate a highly dynamic market successfully. However, challenges related to regulation and privacy must be managed proactively to sustain growth.

FAQs

The metaverse refers to an interconnected virtual reality space where users can interact, work, and play in a digital environment.

Meta primarily generates revenue through targeted advertising on its social media platforms.

Meta’s major products include Facebook, Instagram, WhatsApp, and Messenger.

Meta is working on enhancing user data protection and engaging in discussions with regulatory authorities to address privacy concerns.

Meta aims to shape the future of the metaverse and invest in virtual reality, augmented reality, and technological advancements.

At DailyTrendingStocks, we are dedicated to providing impartial and dependable information on topics such as cryptocurrency, finance, trading, and stocks. It's important to note that we do not have the capacity to provide financial advice, and we strongly encourage users to engage in their own thorough research.

Read More